Global MCU enterprise TOP10 ranking! Domestic MCU breakthrough is expected

Global MCU enterprise TOP10 ranking! Domestic MCU breakthrough is expected

MCU, also known as microcontrol unit, integrates CPU, SRAM, Flash, counter and other digital and analog modules into a single chip to form a small and complete microcomputer system. Benefiting from the explosion of industrial electronics and automotive electronics demand in recent years, the MCU market is also rising, hot track.

Recently, IC Insights, a well-known research institute, released a report that last year, benefiting from the economic recovery after the epidemic, the MCU market demand, unit sales and shipments increased simultaneously, pushing up the MCU output value in 2021 to 20.2 billion DOLLARS, a record high. In terms of shipments, MCU shipments reached 31.2 billion units in 2021, up 13% from the previous year; Average selling prices climbed 12%, the highest annual increase since the mid-1990s.

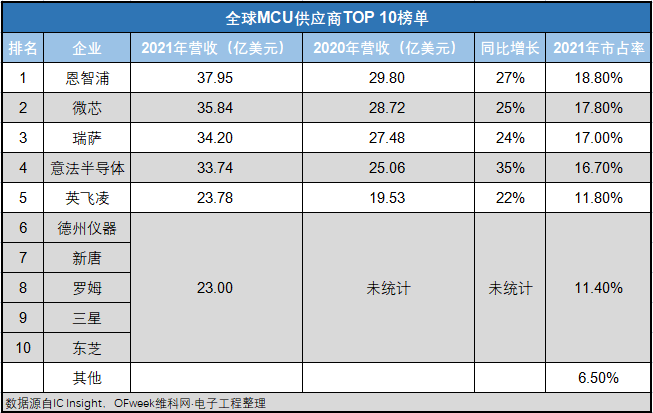

The top 10 leading markets accounted for 93.50%

Specifically, the top 10 MCU suppliers are NXP, Microchip, Renesas, STMICROELECTRONICS, Infineon, Texas Instruments, Xintong, ROM, Samsung, Toshiba. The ranking is virtually unchanged from the previous year, with nine overseas chip giants, except for one, Taiwan-based New Tang Semiconductor.

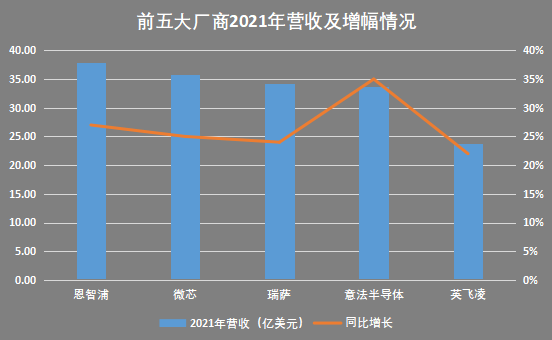

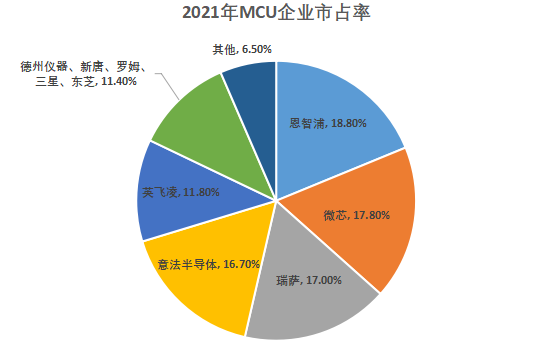

It is worth noting that among the top five vendors, NXP ranked no. 1 with sales of $3.795 billion, with a market share of 18.80% in 2021. It can be seen that the following three companies have little difference in revenue performance, which are Microchip (sales of 3.584 billion DOLLARS, market share 17.80%), Renesas (sales of 3.420 billion dollars, market share 17.00%), Stmicroelectronics (sales of 3.374 billion dollars, market share 16.70%), Infineon ($2.378 billion in sales, 11.80% market share) was slightly behind; In terms of growth, STMICROELECTRONICS led the pack with a 35% year-on-year increase, while the other four saw growth rates between 20% and 30%.

It is worth discussing that the combined 2021 sales of Texas Instruments, Sintron, ROM, Samsung and Toshiba, the top 6 to 10 manufacturers, are only $2.3 billion, even less than infineon, the top 5. In terms of market share, it is close to the same, with a combined 11.40%. As can be seen from the chart below, the top 5 vendors have taken the majority of the MCU market share, occupying a dominant position. Outside the top 10 manufacturers, the remaining enterprises only hold 6.50% market share.

MCU for vehicles has become a growth point

Next, we analyze the specific business situation of the top several manufacturers. The author notes that in NXP's previously announced full-year 2021 results, revenue grew 28.5% year on year in 2021, mainly due to the recovery of growth in all four of the company's key end markets, with significant growth in the strategically focused automotive, industrial and Iot end markets.

NXP said the growth in the automotive end market was driven by a significant increase in demand for NXP's embedded automotive processing solutions, including those addressing the shift to domain and regional processing. In addition, customer adoption of NXP's radar products for ADAS security products and a rebound in demand for advanced analog products, including solutions to support electric vehicle powertrains, contributed to strong year-over-year growth. In the face of many challenges of new energy technologies, NXP also provides integrated battery management solutions including processors, on-board network sensors, drives, analog front ends, and active safety features, enabling customers to better achieve system-level deployment when using them.

Renesas also showed strong growth in the automotive sector. In its 2021 financial results, renesas noted that the company's revenue growth in 2021 was substantial, with a significant contribution from the automotive business. According to the earnings report, the auto business revenue in 2021 was 462.3 billion yen, up 35.6% year on year, mainly due to the recovery of the auto production reduction, including sales growth in the "vehicle control" and "vehicle information" categories, and the auto business non-GAAP operating profit in 2021 was 122.4 billion yen. The year-on-year growth was 153.2%.

Strong demand for automotive chips is expected to drive continued sales growth, according to Takashi Kataoka, head of Renesas's automotive business. This year, auto production is expected to rebound from last year's supply constraints, boosting demand for automotive chips. He also noted that auto inventories remain at historically low levels. Demand for automotive chips is also being driven by a shift to technologies such as electric vehicles and ADAS. Renesas Electronics expects strong revenue and profit growth in 2022, following a strong performance in 2021, amid a global semiconductor shortage.

In its full-year 2021 financial results, STMICROELECTRONICS did not specifically mention progress in its automotive business, but in its financial figures for the fourth quarter of 2021, it was found that STMICROELECTRONICS automotive and power devices revenue was $1.226 billion, up 28.6% year over year; Operating profit rose 129.5 percent to $216 million, with an operating margin of 17.6 percent. Stma CEO Jean-Marc Chery previously said that ST's capital expenditure in 2021 amounted to about $2.1 billion, of which $1.4 billion would go to global capacity expansion and $700 million would go to ST's strategic plan to prepare for the future. Strategic plans here include a new Agrate 300mm (12-inch) wafer plant under construction in Italy, a silicon carbide (SiC) plant in Catania, Italy and a Gallium nitride (GaN) plant in Tours, France. ST is also continuing to invest in the expansion of SiC capacity in Catania, Italy, and Singapore, as well as in vertical integration of the supply chain. Plans to increase SiC wafer capacity tenfold from 2017 levels by 2024 to support the business growth plans of numerous automotive and industrial customers.

In addition, the chief marketing officer of Infineon said in an interview with the media last month that the order backlog of Infineon in january-March 2022, including unconfirmed orders, has increased 19.4% from 31 billion euros in the fourth quarter of last year to 37 billion euros (about RMB 263.362 billion yuan). That's more than three times Infineon's 2021 revenue of 111 euros. Even more surprising, more than half of those orders are for car-related products, and 75% of those orders won't be delivered until the next 12 months. Helmut Gassel further noted that while the overall environment for chips is more challenging than last year, consumer confidence is down and DEMAND related to PCS, TVS and smartphones is weakening, on the other hand, structural drivers have led to very strong demand for automotive, industrial, renewable energy and smart devices, Especially electric car, renewable energy will create new demand for chip industry.

In contrast, the automotive field is not the focus of Microchip's business, which is more focused on low-end industrial control, consumer electronics, etc. And industrial field, also be afore-mentioned several enterprise layout key point likewise.

In general, the global automotive chip supply shortage has a far-reaching impact. The automotive MCU supply problem has been troubled by the industry, especially the development of 2022 is attracting more attention. After all, dozens of MCU chips are required for a gas-powered car. Upgrading to the era of smart cars will increase the demand for MCU chips to between 100 and 200.

From the perspective of the entire automotive electronic structure, no matter the intelligent functions such as body power, vehicle control, information entertainment and driving assistance, or the intelligent systems such as ESP body stability system, ABS anti-lock braking system and engine ECU, MCU chips are indispensable. It can be said that MCU accounts for about 30% of all semiconductor devices equipped with a car. Obviously, the transformation from traditional fuel vehicles to intelligent electric vehicles means that automotive electrification, networking, intelligent, sharing accelerated evolution, these MCU factories also rely on their own deep accumulation, harvest a lot of good opportunities.

How far is it before local MCUS break into the global top 10?

According to the incomplete statistics of OFweek · Electronic Engineering, there have been more than 20 investment and financing events in MCU field since 2021, and the number of financing in 2021 alone is as high as 15, which is equal to the total number of financing in the six years from 2015 to 2020. Specifically, the enterprises involved include Yuntao Semiconductor, Chip Chi Technology, Chip Wang, Hangshun chip, core titanium, Xihua Technology, the Paper and so on.

Compared with the overall layout of overseas manufacturers in the fields of consumer level, vehicle regulation level, industrial level, etc., Chinese domestic MCU manufacturers almost started from the consumer market in the early stage, and then began to enter the vehicle regulation level and industrial level after accumulating in the consumer market.

At present, at the level of consumption, local MCU enterprises have achieved a great breakthrough in some segments represented by small household appliances. Representative manufacturers include Mega Innovation, Kookmin Technology, Huada Semiconductor and so on. In terms of MCU of higher end than consumer level, local manufacturers have made some achievements, but they are relatively few. Their main fields are also focused on 8-bit MCU products in low-order fields such as headlights, windshield wipers and air conditioners.

Why does this happen? The author thinks there are two main reasons. One is that the major automobile manufacturers are based on the Complete vehicle brands in The United States, Japan and Europe, and their supply chain is relatively fixed, especially after adopting the MCU of NXP, Renesas, Infineon and other established semiconductor manufacturers, they will not easily replace the supply chain. And a car regulation chip generally takes 2-3 years to produce energy and enter the supply chain of vehicle enterprises, after entering the need to maintain a supply cycle of up to 5-15 years. Local MCU manufacturers are late, even if they cut into the track, they can only be implemented in some relatively niche brands of vehicles. If they want to cut into the entire automotive ecosystem, they can only be qualified unless they can really enter the supply chain of Japanese, European and American vehicle brands.

On the other hand, at the technical level, compared with the consumer level MCU, vehicle gauge MCU needs to meet more stringent requirements of "high safety, high reliability and high stability" technical standards (such as reliability standard AEC-Q100, quality management standard IATF16949, functional safety standard ISO26262). Need to go through a more rigorous process of research and development, manufacturing, testing and certification. However, local MCU manufacturers have not been able to meet the requirements in the chip design capability and wafer manufacturing process requirements of high-performance vehicle-scale MCU products. Therefore, the high level of technical standards, long-term and stable supply cycle, and long-term cooperation with middle and downstream parts suppliers and vehicle manufacturers, these factors together constitute the industry barriers of MCU.

After reviewing the financial statements of many original MCU factories in A-share market, the author found that local enterprises led by Zhaoyi Innovation and Zhongying Electronics also achieved great achievements in the field of MCU products. Take a few typical representatives as follows:

Trillion easy innovation

In 2021, the company achieved operating revenue of 8.510 billion yuan, an increase of 89.25% compared with the same period in 2020, and net profit attributable to shareholders of listed companies was 2.337 billion yuan, an increase of 165.33% compared with the same period in 2020. In terms of specific products, the revenue of microcontroller (MCU) products was 2.456 billion yuan, an increase of about 1.701 billion yuan over the previous year, up 225.36% year-on-year.

Zhaoyi innovation said the production and sales growth of microcontroller products, mainly in response to market demand, increase production capacity to ensure product supply. The company's innovative MCU products are based on the ARM Cortex-M series of 32-bit universal MCU products, and the world's first RISC-V core-based 32-bit universal MCU products launched in August 2019. The company's products support a wide range of applications, such as industrial controls, user interfaces, motor drives, power monitoring, alarm systems, consumer electronics and handheld devices, automotive navigation, T-box, automotive instrumentation, automotive entertainment systems, unmanned aerial vehicles, Internet of Things, solar photovoltaic controls, touch panels, PC peripherals, and more.

It should be noted that the total MCU sales of the 6th to 10th vendors in IC Insights' list were about $2.3 billion, and the average MCU sales were about $460 million (about 3.82 billion YUAN). That is to say, mega yi's innovative MCU revenue is not far behind that of Toshiba, which ranks 10th on the list. This year, as the market improves and the domestic substitution trend intensifies, MEGA Innovation may have a chance to become the first local MCU vendor to break into the top 10 list.

Ying in the electronic

In 2021, the shortage of MCU in the world is serious, and domestic white appliance manufacturers are focusing on the introduction of domestic MCU as an auxiliary solution. Zhongying Electronics has become the main choice of domestic MCU for white appliance manufacturers. Ying electronics are not specifically pointed out in the 2021 results MCU product revenue accounts for the contribution ratio, but from its reveal, the company in the world of MCU sales accounted for nearly 1%, and MCU products, belong to the level of control in the product, compared with the consumer electronics, has the high reliability, long certification cycle and product life cycle is long.

With the previous stock out of stock market, foreign IDM factories will focus on the supply of automotive electronics applications, resulting in the domestic white MCU application market localization process accelerated, zhongying electronics in the field of frequency conversion everybody in the field of mass production breakthrough. It is expected that in the future period, the market share of the white goods MCU industry is expected to increase again, and continue to provide growth momentum for performance. At present, Zhongying electronics has taken the lead in mass production of 32 bit MCU in the large client of small household appliance. With the product characteristics of high quality and comprehensive support, it is expected that the turnover in the small household appliance market will be further expanded.

Fudan microelectronics

Fudan Microelectronics is one of the earliest enterprises to enter the MCU chip design for smart meters in China, and has profound technical reserves in this field. In the MCU product line, Fudan Microelectronics mainly includes smart meter MCU, universal low power MCU, etc. In 2021, the sales revenue will be about 296 million yuan.

According to Fudan Microelectronics, the product line in 2021 in the supply chain capacity supply pressure is greater, efforts to cooperate with customers to submit for inspection, mass production, continue to follow up the high protection, long life meters and other norms change, business revenue maintained a growing trend. In industrial control, smart home, automotive electronics and other fields, the proportion of universal low-power MCU is gradually increasing. Fudan Microelectronics has accumulated a lot of practical experience in MCU chip underlying driver development, application software development and other fields. Through tools such as "Rubik's Cube" and self-built ecology, it can greatly reduce the threshold of user technology development and shorten the time to market of customer products.

The national technology

National technology universal MCU product line has formed a relatively rich and competitive product layout in the market. In terms of product performance, the MCU chip series products of National Technology have the characteristics of safety, low power consumption, high performance, high reliability and high integration. Meanwhile, it provides relevant industry application solutions, forming a comprehensive market competitive advantage of leading technology, full product coverage and industry-specific solutions.

In terms of product categories, it has formed a product matrix of "wide product line and high coverage", and launched a number of general security MCU series mass production products based on ArmCortex-M0 and M4 kernel, which have achieved batch supply. Currently, more than 100 models are on sale and a number of product platforms will be completed in the past two years. Will cover most application scenarios from low-end to high-end 32-bit MCUS; The high performance ARM Cortex-M7 products under development can cover most application scenarios of 32-bit MCU from simple configuration to high configuration, to better meet the different product requirements of different industries and different customers.

Neusoft carrier

Neusoft CARRIER Integrated Circuit board has built a complete MARS chip product architecture according to the needs of global intelligent manufacturing transformation customers and IoT industry customers. It has an industrial high anti-interference microcontroller chip research and development platform, which is widely used in white goods, industrial control, instrumentation, automotive electronics and other fields. On MCU products formed eight / 32 general industrial microcontroller chips, white goods, microcontroller chips and circumjacent special discrete device integration chip, industrial-grade for iot wireless chips, used for medium and small power motor control of 32-bit microcontroller and high voltage driver chips, used in small power lithium battery management 32-bit microcontroller chips, used for instrument 32 bit microcontroller chip for instrument control, energy router for smart power grid, energy controller, high-performance multi-core MPU edge computing chip for operation and distribution integration terminal, etc.

"Lack of core" protracted war, domestic MCU breakthrough is hopeful

According to IC Insights' forecast, global MCU sales will grow by 10% to reach a record high of $21.5 billion in 2022; Total MCU sales are expected to grow at a compound annual growth rate of 6.7% from 2021 to 2026 and reach $27.2 billion in the final year of the forecast.

From the perspective of the development of China's MCU industry, thanks to the rapid growth of the Internet of Things, new energy vehicles and other fields, the demand for MCU products in downstream applications remains strong, and the growth rate of China's MCU market continues to lead the world. The research data show that the MCU market size in China will maintain a growth rate of 8% from 2021 to 2026, which will be about 36.5 billion yuan in 2021 and 51.3 billion yuan in 2026.

According to the analysis of the data in the past few years, although 8-bit MCU still occupies a dominant position in the DOMESTIC MCU market, its market share in MCU is gradually declining. Vehicle driving information system, the throttle control system, automatic parking, cruise control, advanced anti-collision system ADAS system such as demand for the 32-bit MCU chip, will greatly enhance the future MCU industry market share dominance will be replace by 32-bit MCU, and car level gauge and industrial-grade products will be MCU industry in the future the main goal of the market in the global market.

In China, the first enterprises to enter MCU in consumer electronics, IC card and other fields of development has been relatively mature, then focus on the computer and network, automotive electronics, industrial control these three directions. At present, the Chinese economy revived and continue to strengthen, and there is still a large outbreak, overseas in iot, emerging application domains such as medical electronics, new energy development, China's electronic machine production as a whole under the influence of favorable factors such as continuous and rapid development, China MCU market will continue to maintain good growth momentum, expanding the size of the market will continue to maintain growth, Local MCU companies are expected to gain more attention and opportunities in this wave of domestic alternatives.